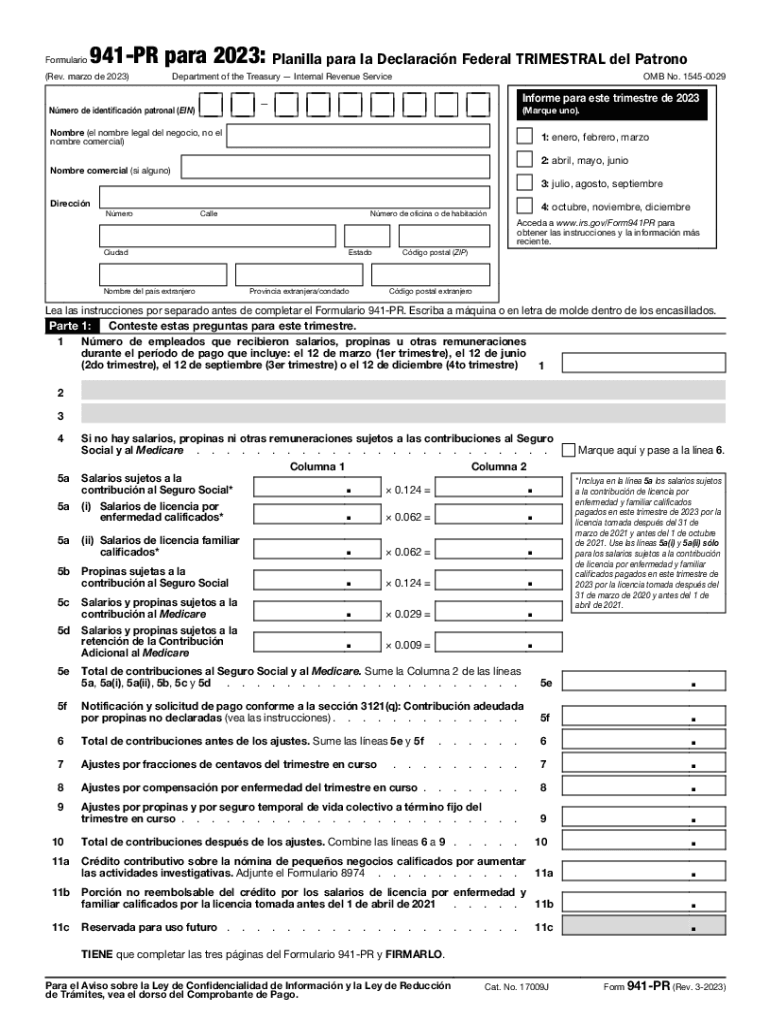

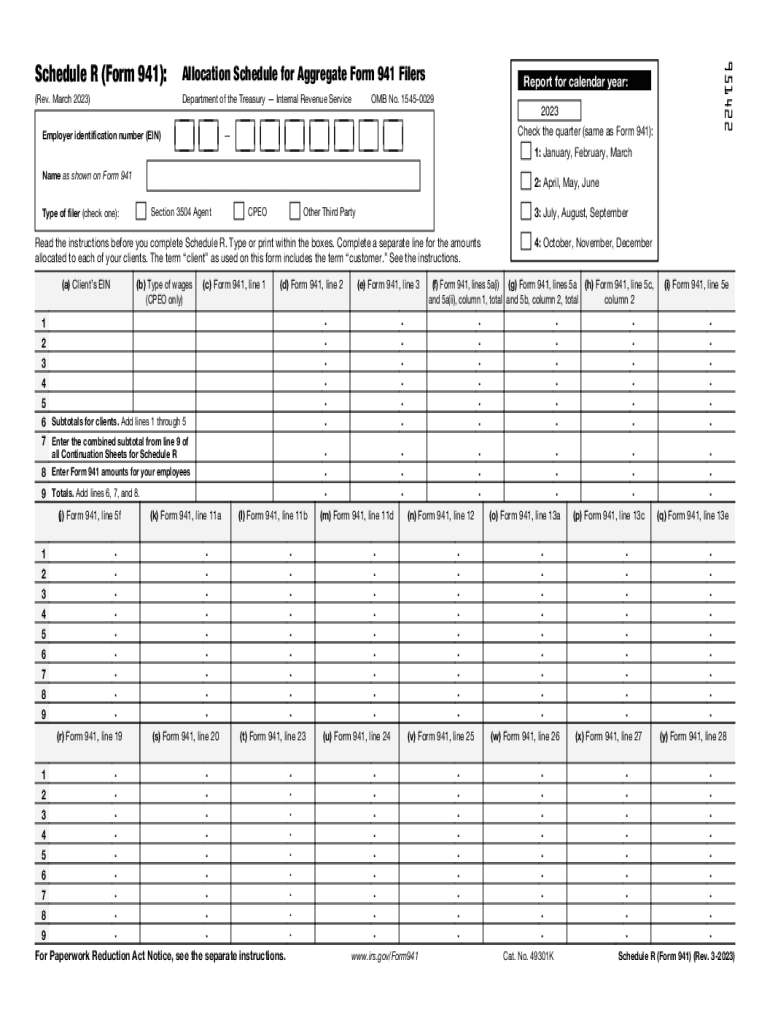

Form 941 For 2025 Schedule B. Schedule b, report of tax liability for semiweekly schedule depositors;. The irs uses schedule b to determine if you've deposited your federal employment tax liabilities on time.

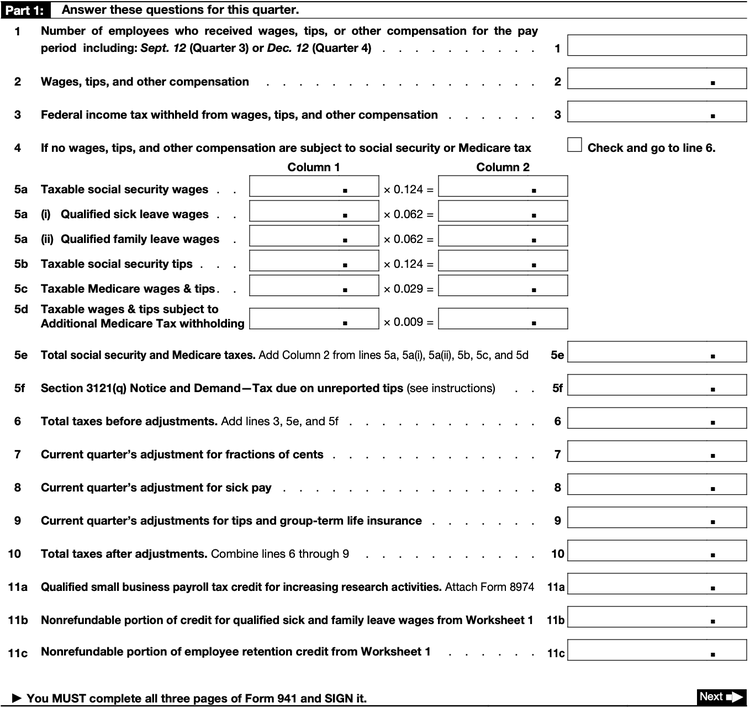

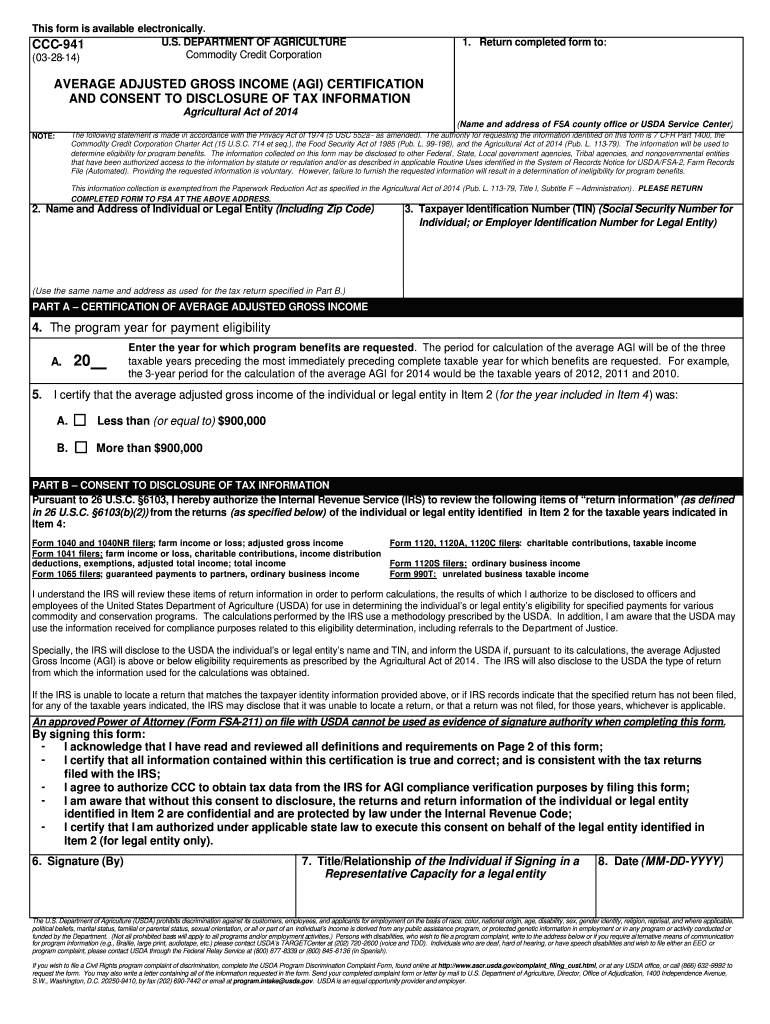

Form 941 reports federal income and fica taxes. Know how to fill out irs form 941 schedule b for 2025 and 2025.

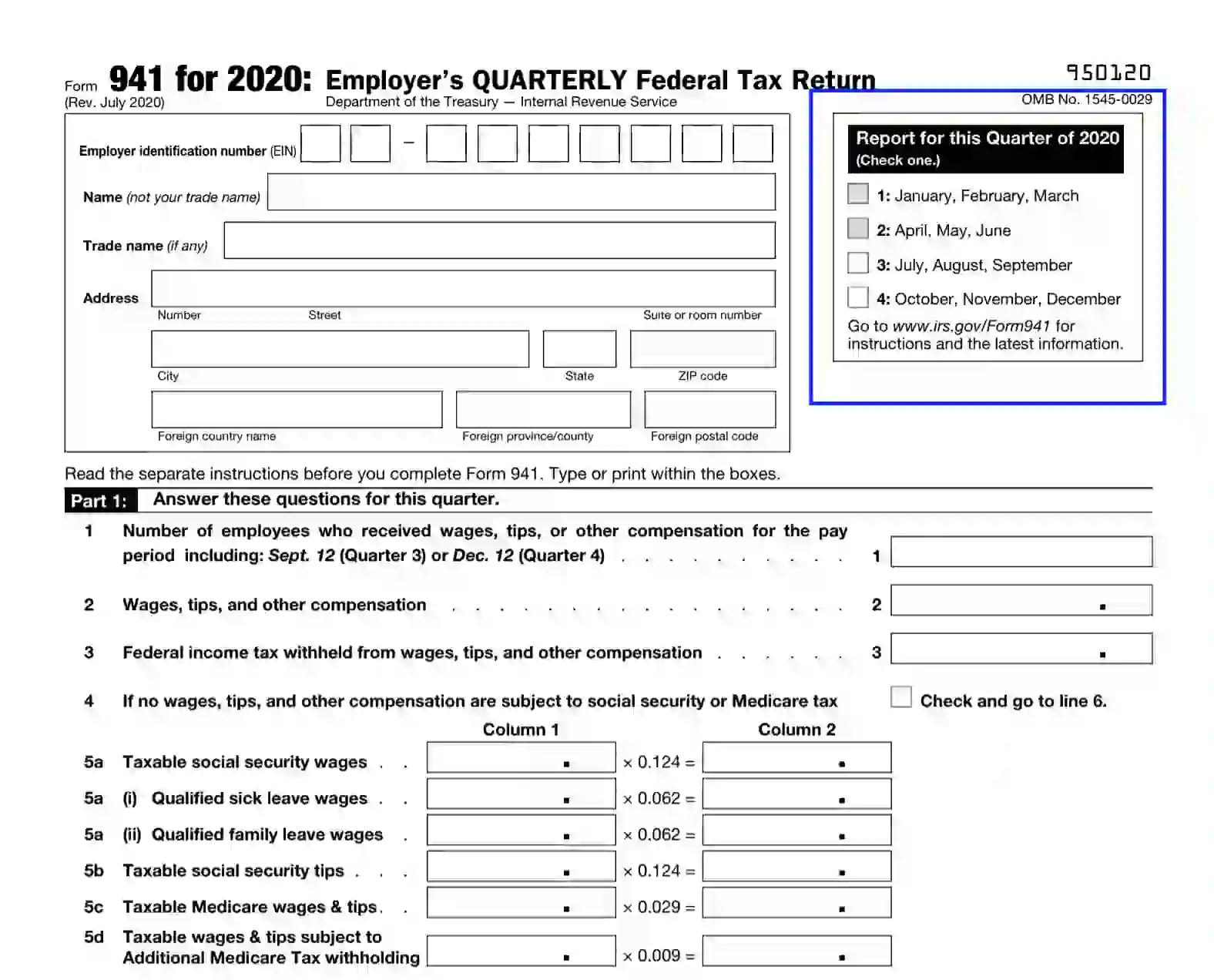

Most businesses must report and file tax returns quarterly using the irs form 941.

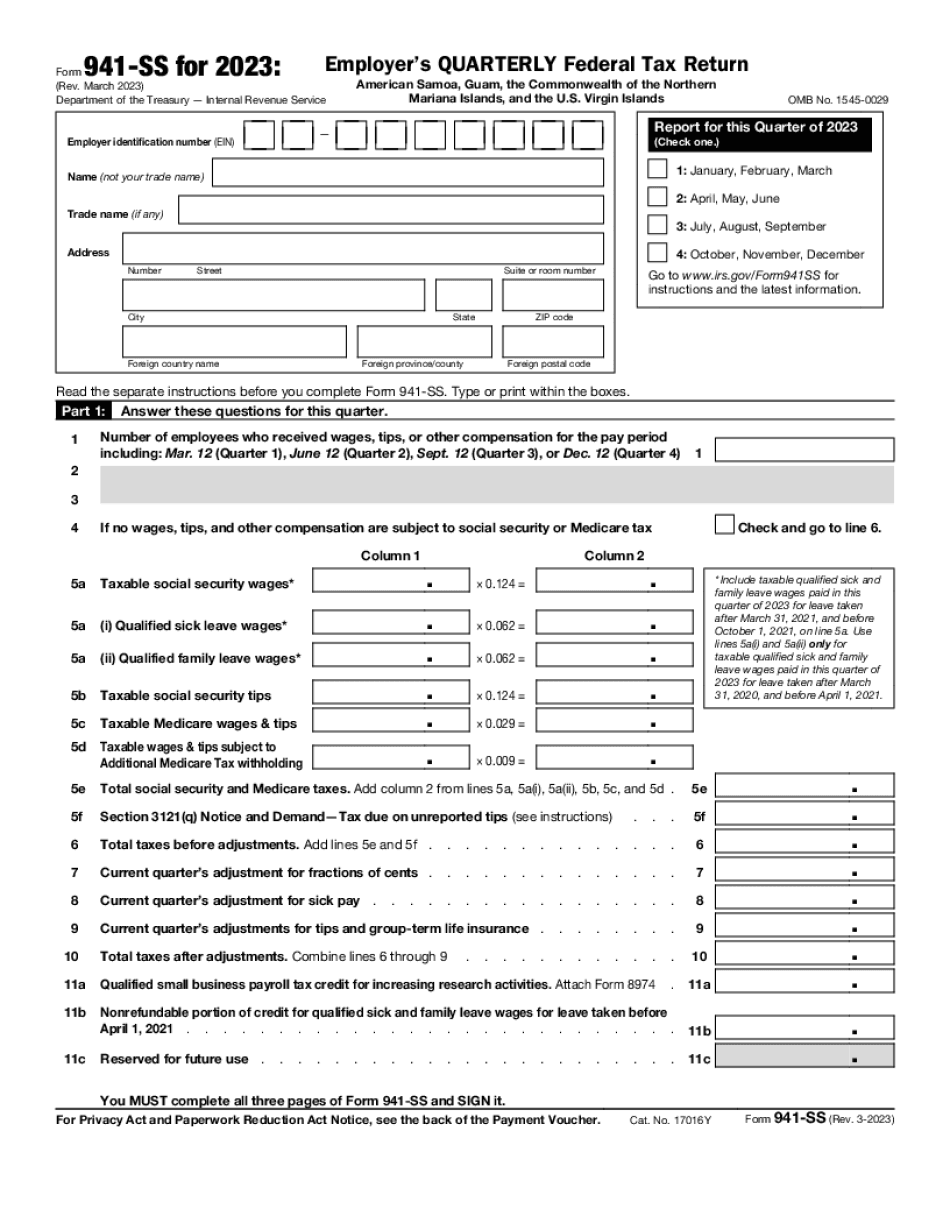

941 Schedule B For 2025 Trudy Ingaberg, When filing through the mail,. Form 941 schedule b is used by semiweekly schedule depositors to report their tax liability to the irs along with form 941.

941 Forms 2025 Neysa Adrienne, Form 941 reports federal income and fica taxes. The irs recently released its 2025 form 941, schedule b, and schedule r along with the accompanying instructions.

Ir S Form 941 Fill Out And Sign Printable Pdf Templat vrogue.co, Most businesses must report and file tax returns quarterly using the irs form 941. These instructions tell you about schedule b.

ezPaycheck Payroll How to Prepare Quarterly Tax Report, Form 941 reports federal income and fica taxes. A deposit schedule is used to tell businesses when to.

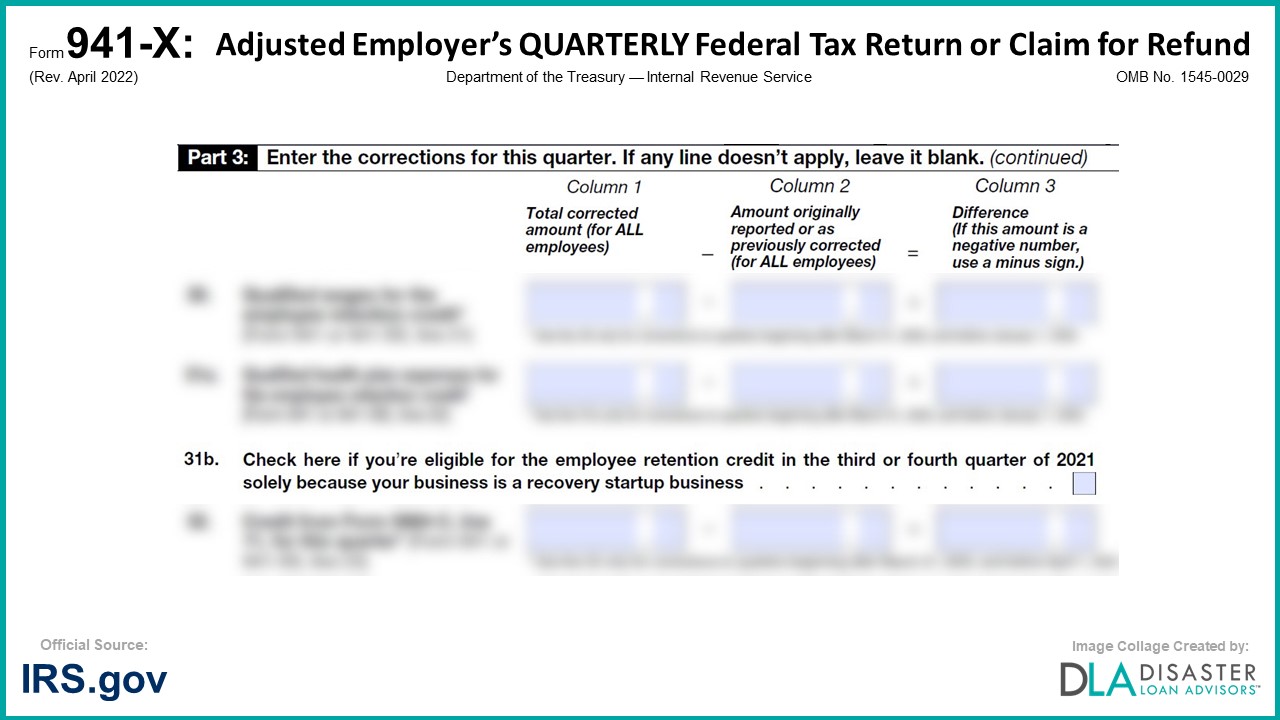

941X 31b. Recovery Startup Business Checkbox, Form Instructions, This guide provides the basics of the 941 form, instructions to help you fill it out,. Form 941 reports federal income and fica taxes.

IRS Instructions 941PR Schedule B 2025 Fill and Sign Printable, When filing through the mail,. This webinar will give you the tools to better be able to understand line by line of the form 941.

941 for 20252025 Form Fill Out and Sign Printable PDF Template, Form 941 schedule b is used by semiweekly schedule depositors to report their tax liability to the irs along with form 941. It’s important to avoid using schedule b to show.

Irs Form 941 Schedule B 2025 Kore Shaine, Most businesses must report and file tax returns quarterly using the irs form 941. Several changes have been made to the 941 and to.

Irs R 941 20252025 Form Fill Out and Sign Printable PDF Template, 941 schedule b is used to report an employer’s daily tax liability to the irs. Employers must file irs form 941, employer's quarterly federal tax return, to report the federal income taxes withheld from employees, and employers' part of social security.

Il 941 Instructions 2025 alvira, Several changes have been made to the 941 and to. Schedule b, report of tax liability for semiweekly schedule depositors;

Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for federal income taxes withheld from employees.